The recent market correction presents a compelling opportunity for investors to increase their allocation towards equities. While many are still fixated on the Mid Cap and Small Cap indices, comparing them to past PE multiples, a deeper analysis reveals strong reasons why this is an excellent entry point for long-term investors

Key Reasons to Consider Increasing Equity Allocation

1. Market Correction Has Created Attractive Valuations

Indian markets, across various indices and stocks, had previously run ahead of valuations. However, over the last 4-5 months, we have witnessed a significant correction:

Most indices are down by 15-20% from their recent highs.

Many stocks have declined by 25-35%, making them available at more reasonable valuations.

The Nifty 50 PE ratio has come down from 24x to 20x, indicating a more attractive entry point for long-term investors.

FII (Foreign Institutional Investor) outflows in the last quarter have led to short-term volatility but present a long-term buying opportunity. This correction has created an opportunity to enter quality stocks at discounted prices.

2. A Pro-Growth Union Budget 2025

While the immediate market reaction to the Budget may not have been euphoric, it was undeniably one of the best Budgets for the middle class in recent times. The tax relief measures introduced will increase disposable income, ultimately driving consumption and economic growth.

3. Policy Support and Economic Stimulus

Several proactive steps have been taken by the government and regulatory authorities to support economic growth:

- The Finance Minister delivered one of the most growth-oriented budgets of the decade.

- The RBI has injected liquidity into the financial system to support growth.

- A rate cut has been announced, improving borrowing conditions.

- The government has initiated new capital expenditure (capex) plans, providing a boost to key industries. These measures will help the economy gain momentum and reflect positively in corporate earnings and stock prices.

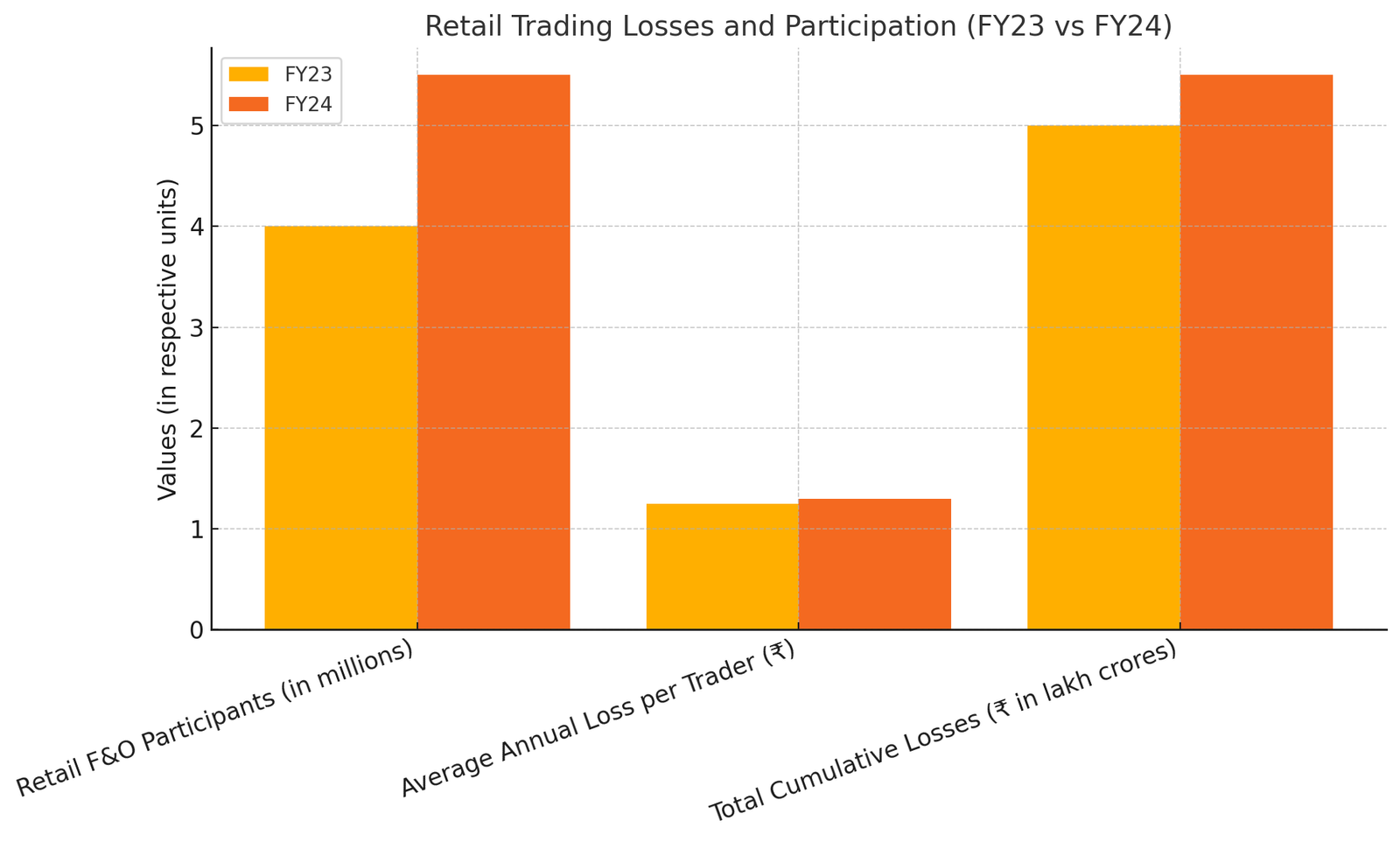

4. A Market Reset for Speculators

Over the last few years, many new entrants in the market focused more on stock trading rather than business fundamentals. The recent sell-off and panic selling have acted as a reset, teaching important lessons about leveraging and speculation. This shift could lead to a healthier market with more rational participation.

5. Large-Cap and Financial Stocks Are Undervalued

Rather than looking at index levels alone, investors should focus on individual stock valuations. Many large-cap stocks, particularly in the financial sector, are trading at 2020 valuation levels despite significant business growth. Several financial stocks have been range-bound for the last two to three years and are now poised for a breakout.

6. India’s Long-Term Growth Story Remains Strong

- The country’s GDP is expected to grow at 6.5-7% CAGR over the next few years.

- Government policies continue to focus on infrastructure, manufacturing, and digital transformation, which will drive long-term growth.

- Corporate earnings are projected to grow at a 15-18% CAGR in the coming years, leading to a strong re-rating of many stocks.

7. Advance-Decline Ratios in Key Market Corrections:

- February 2025: 0.70

- March 2020 (COVID Crash): 0.69

- October 2008 (Global Financial Crisis): 0.57

This has been one of the worst months with such a low advance-decline ratio. Historical data suggests that the market is deeply oversold, indicating a potential reversal or a strong recovery phase ahead.

How to Approach Investing in This Market

Rather than looking at indices in a blended form, focus on identifying stocks that are available at attractive valuations. Many stocks with strong growth potential over the next 2-4 years are currently trading at just 15-20x PE on a trailing twelve-month (TTM) basis. This opportunity has arisen due to leverage-driven panic selling, where fundamentals were ignored in favor of indiscriminate selling.

Final Thoughts

Market corrections often provide the best opportunities for long-term investors. While short-term uncertainties may persist, the underlying fundamentals remain strong. Identifying and investing in quality businesses at reasonable valuations today can generate substantial returns in the coming years. As always, a disciplined approach, research-driven stock selection, and a long-term perspective will be key to maximizing this opportunity.