The COVID-19 pandemic reshaped the global economy in unprecedented ways, leading to shifts in how individuals manage their finances and invest. One of the most notable outcomes has been the significant increase in retail participation in the stock market. What initially appeared as a democratization of investing has, for many, evolved into a complex web of challenges, including financial losses, psychological distress, and long-term debt traps.

The allure of quick profits, particularly through Futures & Options (F&O) trading, has captivated millions of new market entrants. However, the data and anecdotal evidence suggest that this journey has not been smooth for many. While the markets have offered opportunities, they have also exposed vulnerabilities, particularly for retail investors who lacked financial literacy and risk management skills.

Why Did Retail Participation Surge Post-COVID?

The pandemic brought life to a standstill, forcing individuals to explore alternate income sources and avenues for financial growth. The stock market became a prime target due to several converging factors.

First, the widespread adoption of user-friendly trading platforms made investing and trading more accessible than ever before. Apps like Zerodha, Groww, and Upstox eliminated traditional barriers to entry, such as high brokerage fees and complex interfaces, enticing millions to open Demat accounts.

Second, governments and central banks injected massive liquidity into the global financial system to stave off economic collapse. This fueled stock market rallies, creating an illusion of perpetual growth. For new entrants, this bull market seemed like a low-risk, high-reward opportunity.

Third, the isolation of lockdowns meant that people had time to explore and experiment with the markets. Stories of others making quick gains during the pandemic circulated on social media, sparking curiosity and FOMO (fear of missing out).

Finally, many were drawn to F&O trading, which promised quick returns. However, what they did not anticipate was the complexity and risk associated with derivatives trading.

The Role of Government and Regulators

One of the less-discussed but crucial factors contributing to the surge in retail trading has been the role of government and regulatory decisions. While encouraging market participation is generally seen as positive, certain actions inadvertently fueled speculative behavior. SEBI’s introduction of daily expiries in derivatives transformed what was once a disciplined trading landscape into a high-stakes arena, disproportionately favoring seasoned and algorithmic traders over retail participants. Exchanges compounded the issue by creating easy access for speculative activities, such as allowing low-quality SME IPOs to flood the market, leaving many retail investors vulnerable to significant post-listing losses.

Adding to the frenzy were public statements by top BJP officials, including the Prime Minister and influential leaders like Amit Shah, who explicitly commented on market trends. Statements such as “PSUs are undervalued” or recommendations to “buy before specific dates” created unwarranted euphoria among their massive fan base. Retail investors, driven by blind trust in such figures, often jumped into markets without proper due diligence. When these speculative waves turned sour, inexperienced participants bore the brunt of the financial fallout. Additionally, increased taxes on LTCG and STCG by the Finance Ministry made long-term investing less attractive, indirectly pushing retail investors toward high-risk F&O trades for quick returns.

The Impact of Increased Participation

While increased participation in the stock market is often viewed as a sign of growing financial literacy and inclusivity, it has also created significant challenges. The majority of new entrants, driven by the allure of quick profits, entered speculative trading without a solid understanding of market dynamics.

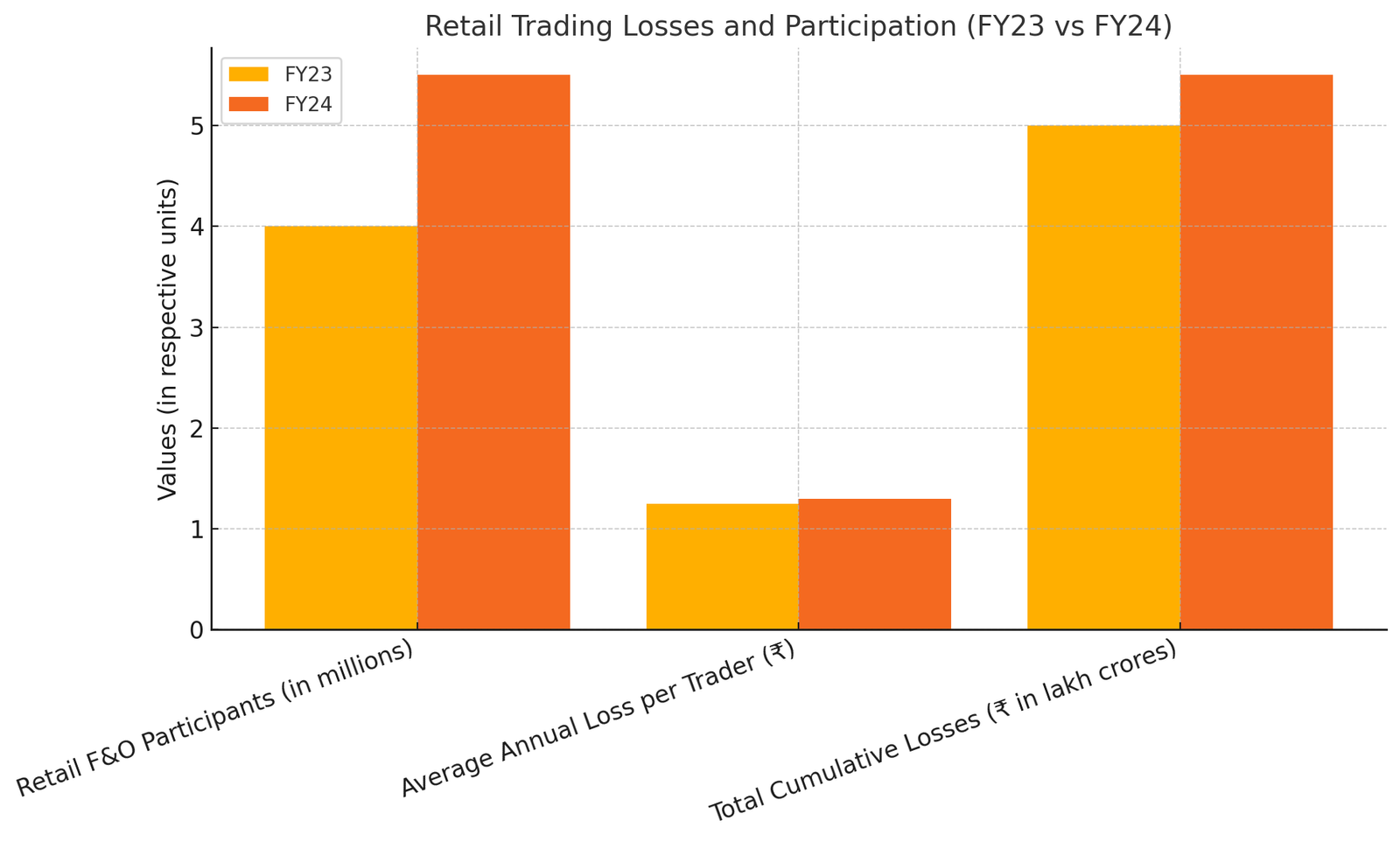

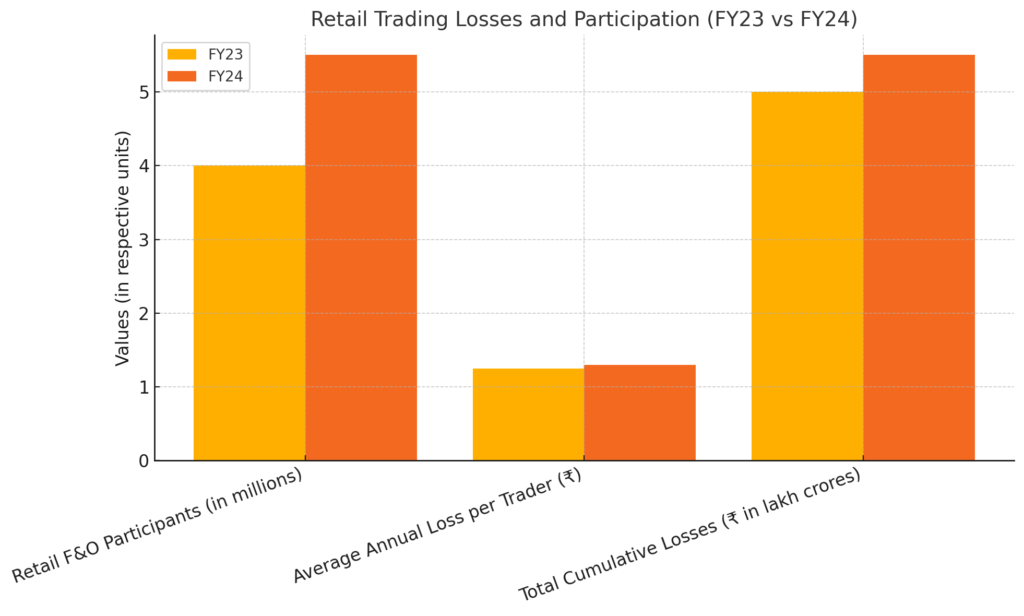

The rise of F&O trading is a critical aspect of this trend. According to SEBI’s reports for FY23 and FY24, retail investors have incurred staggering losses in this segment. Over 90% of F&O traders suffered losses, with the cumulative retail losses exceeding ₹5 lakh crores in FY23 alone. The average annual loss per trader stood at ₹1.25 lakh, a significant amount for individuals in middle-income brackets.

This trend has led to increased volatility in the market, with speculative bubbles forming in certain stocks. Novice investors, influenced by social media trends and herd mentality, often buy overvalued stocks, only to face heavy losses when prices correct.

A Cautionary Tale: The Rise and Fall of Person A

Consider the story of Person A, a small business owner in his early 30s who initially dabbled in trading out of curiosity. His first few trades yielded quick profits, which boosted his confidence. He believed he had found a way to supplement his income with minimal effort. However, as his confidence grew, so did his risk appetite. He began infusing larger amounts into F&O trading, often borrowing funds to increase his exposure.

In the initial phase, Person A experienced success, doubling his capital in a few months. However, market conditions turned against him. Erratic price movements and his over-leveraged positions led to mounting losses. Determined to recover, he infused more funds, eventually draining his savings and borrowing heavily to stay in the game.

Over the course of a year, Person A lost ₹40 lakh, including personal savings, business capital, and loans. The psychological toll was immense—stress, guilt, and the constant replay of missed opportunities haunted him. His business suffered, personal relationships strained, and he found himself trapped in a cycle of desperation and regret.

Person A’s story reflects the broader issue faced by many retail traders, particularly those who venture into F&O without fully understanding the risks.

The Psychological and Emotional Toll

The financial losses incurred by retail investors often lead to significant psychological challenges. Many individuals equate financial success with personal worth, and losses in the stock market can erode their confidence.

Retail traders in a debt trap often face severe stress and anxiety. The pressure to repay loans and recover losses creates a vicious cycle, where desperation leads to impulsive and irrational decisions. This phenomenon, often referred to as “revenge trading,” exacerbates the problem, pushing individuals further into debt.

Moreover, the shame associated with financial failure can isolate individuals from their support systems. Relationships suffer as traders conceal their financial struggles from family and friends, leading to feelings of loneliness and despair.

What Needs to Be Done?

The surge in retail participation post-COVID highlights the need for systemic changes and better support for new investors. Here are some key steps that can address the challenges:

- Improving Financial Education: Regulatory bodies like SEBI must emphasize financial literacy. Programs and campaigns should focus on educating investors about the risks of speculative trading and the importance of long-term investment strategies.

- Restricting High-Risk Trading: Access to high-risk trading tools, such as F&O, should be limited to individuals who demonstrate adequate financial knowledge or meet specific income thresholds.

- Promoting Risk Management: Brokers and platforms should provide tools and resources to help investors manage risk effectively. Features like stop-loss orders, portfolio diversification guidance, and risk calculators can empower retail investors.

- Addressing Debt Issues: For individuals trapped in debt due to trading losses, access to professional financial counseling and debt restructuring services is crucial.

- Regulating Broker Practices: Brokers must prioritize investor education over trading volumes. Clear warnings about the risks of leveraged trading should be mandatory.

Conclusion: A Lesson in Balance and Restraint

The post-COVID surge in retail market participation is a double-edged sword. While it reflects growing awareness and interest in financial markets, it has also exposed the vulnerabilities of inexperienced investors. The allure of quick profits through F&O trading has lured many into financial and psychological distress.

As SEBI’s data indicates, the stock market is not a shortcut to wealth. It demands discipline, patience, and a commitment to long-term goals. For retail investors, the focus must shift from speculative trading to informed, stable investing. Governments, regulators, and financial institutions must work together to create an ecosystem that fosters growth while safeguarding the interests of retail participants.

The stock market has the potential to be a powerful tool for wealth creation, but only when approached with caution, knowledge, and a clear strategy. Let the lessons of the past few years guide us toward a more sustainable and inclusive financial future.

“The stock market is a device for transferring money from the impatient to the patient.”

– Warren Buffett